Employee skill gaps can zap any organization’s productivity. Low productivity costs the median S&P 500 company $116 million annually, according to McKinsey research.

How is your L&D department helping?

Whatever you do, you must show that your learning programs improve skills, productivity, revenue, or other important metrics for leadership. In other words, you must show how L&D delivers the best ROI of learning, not just any old ROI of learning.

Companies have no time or money to waste, so if you can’t prove your learning solutions are solving critical business problems, your L&D budget could be sliced. Protect and expand your budget and influence. How? Upskill yourself in tracking and explaining success metrics that matter the most to leadership.

Here’s how to find the best way to track and communicate the best ROI of learning and development in your organization.

What are the best metrics for ROI of learning?

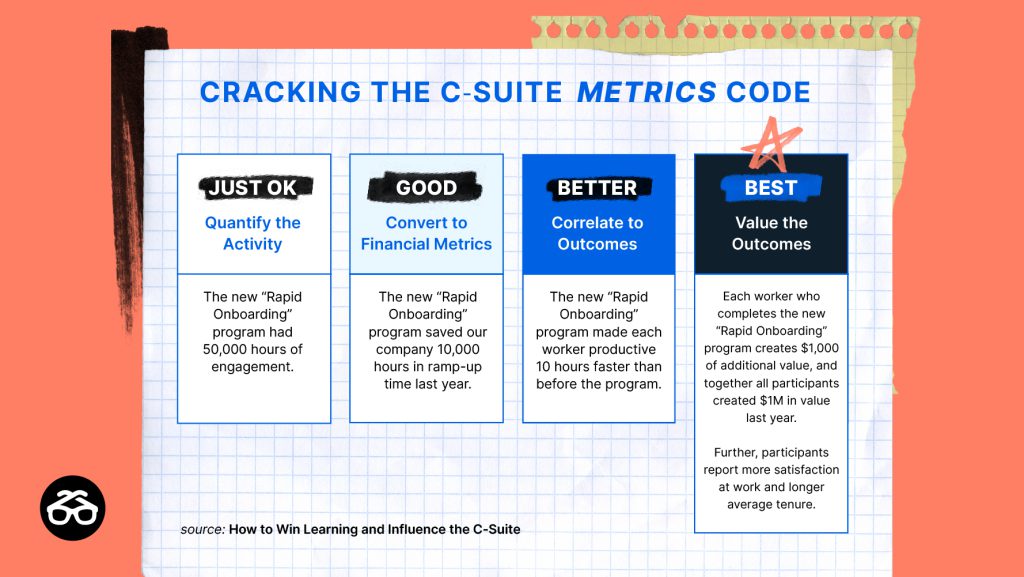

The metrics you track to understand L&D within your team are great, but they’re not the ones executives will care about or understand. You have to translate them for the C-Suite.

L&D leaders know that the impact of learning reaches far beyond a balance sheet, but they tend to speak in metrics like course completions, learning hours achieved, and engagement surveys. The problem is that executives don’t always see how these successes cause profit. They don’t always see the business value. You have to get them there.

Some measures are qualitative, like worker confidence and morale. But make no mistake, qualitative benefits do affect the company’s bottom line. Combining qualitative and quantitative metrics gives you the hard, relevant data points executives look for—and helps tell the human side of the story.

More Revenue

The absolute best way to prove the ROI of learning and development at your organization is by linking it to revenue generation. It’s a clear signal to executives that money spent on tools, processes, and L&D personnel are investments, not simply a cost.

Where should you look for links to revenue generation? Check your company’s financial documents and see how they slice up revenue. Then grab revenue metrics from those areas and connect them to specific L&D initiatives. Here are a few examples:

Sales

Sales is the number one place to find opportunities to link L&D to revenue, so make it your first stop.

For a quantitative measurement, get a baseline on sales numbers before you deliver a specific training, then measure them afterward. Compare them to the same period in previous years to account for seasonality. Also, consider the typical sales cycle for specific products or services. If it takes three months to close a deal, the true impact of a new sales training program will take at least that long to show up in the data.

As a quantitative measure, look to customer NPS scores. If sales associates are successfully matching customers with the best products for their needs, properly setting expectations, and weeding out customers that aren’t a good fit, then customers will be happier with their purchases—and your company. You’ll also be able to tie your efforts to boosting brand reputation, customer loyalty, and overall long-term customer value.

Product

Imagine starting a new program to help turn research and development (R&D) into successful new products. One metric could be analyzing the change over time in the ratio of R&D spending to new-product sales. To do this, understand how each dollar of R&D investment translates to new-product sales before and after your first cohort, then regularly afterward.

Depending on your industry, your R&D-to-sales cycle might take three or more years. (Yes, showing the value of learning can be a particularly long game to play). But no matter the sales cycle length, get a baseline before you launch your academy, then track these for several years afterward through multiple new product launches. Once you have your results, pair them with product reviews and share any stand-out quotes from reviewers.

Fewer costs

Sometimes the ROI of learning lies in what a company doesn’t spend. So if you can’t show executives how you make them money, the next best thing is to show how you save them money. The greatest opportunities to save your company money are often in salaries, retention, and recruitment, so start there.

Salaries

According to a LinkedIn study, 74% of Gen-Zers want to learn new skills—about as much as they want to be successful (73%) and be financially secure (73%). And that means companies with robust skill development can attract new talent at cost-efficient salaries.

Recruiters can leverage growth opportunities against salary considerations to pull in more talent at a lower cost. You can help by showcasing your learning and growth opportunities in your company’s employee value proposition (EVP). Once you do, compare changes in average salary from before and afterward. Continue to track these numbers as you launch and showcase programs for specific types of roles.

Recruitment

When learning is part of your company’s EVP, recruiters can expand their hiring pool to candidates who have skills adjacent to a role’s skills. In other words, they can hire people poised to quickly upskill—which can be even faster and more cost effective than hiring a candidate who already has a full skillset. Plus, you’ll be giving new hires additional opportunities that can boost job satisfaction.

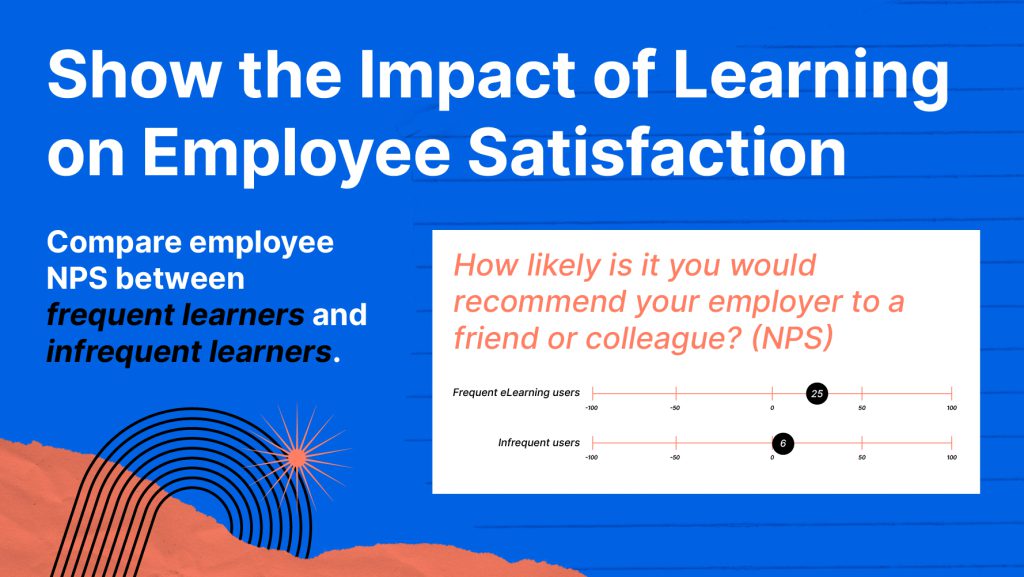

So alongside changes in salary, show executives any improvements in employee NPS scores of trainable new hires. You’ll show that L&D has saved your company recruitment costs now—and how you’ll help keep employees engaged and loyal in the long run.

Career Mobility

Speaking of recruitment, it’s no secret among HR, Talent, and L&D that companies often save money building skills internally rather than buying or borrowing them. But this can be news for executives.

Often, executives use a simplified equation to calculate recruitment costs. Many consider only the administrative costs of hiring a candidate—which comes out to around $4,000 per role. You know that getting a new employee up to speed with onboarding—and continuing to develop them—costs far more. Gallup estimates that voluntary turnover costs U.S. businesses alone over $1 trillion annually.

Retaining more talent and promoting from within the organization can put a huge dent in recruitment costs, so include them in your reports to the C-suite. Calculate how long it takes to onboard new employees and get them performing optimally—which can take up to three years. Then multiply that by their compensation for that time. Amortize the cost of creating and maintaining that training and add that to the new-hire price tag, too.

Retention

According to Gallup, employee engagement has been steadily dropping since 2021. And low engagement leads to lower retention. Gallup also found that opportunities to learn and grow dropped more than many other elements of engagement.

The ability to upskill and reskill employees helps your company keep the talent it has while reducing the need to recruit new talent. And that means recruitment savings.

For most L&D pros, that won’t come as a surprise. You’ve known that learning helps keep workers engaged, and engaged employees are more likely to stick around. But for the C-suite, the connection may not be as obvious.

Show how L&D is combatting low engagement—and turnover—by tying your most robust learning programs to retention rates among the employees who engage in learning. Go even further by calculating recruitment costs—and by multiplying them by the employees you’ve helped hold onto.

Recently a bank shared how participants in leadership training significantly boosted retention and career mobility. And they did it using specific metrics to illustrate their point. In fact, this customer story is a bit of a masterclass on proving the value of your learning programs to business leaders. If you’re curious about how they did it, download Bank Boosts Employee Performance & Cuts L&D Costs.

Business alignment is critical.

Tracking and communicating the ROI of learning is challenging, but if you balance quantitative and qualitative metrics, you can tell the story of your impact in meaningful ways. Deciding which metrics to use can be tricky, but you don’t have to come up with them in a vacuum. In fact, it’s better if you let executives tell you which metrics they want to see. They’ll do this by setting business goals.

If you’re not sure what leaders are trying to solve, download our guide How to Win Learning and Influence the C-Suite. You’ll get a step-by-step guide to aligning learning programs with business goals—and to making L&D a key partner in solving business critical problems.

Will your company be like those losing $116 million per year in productivity due to the skills gap? When you discover critical company goals, find a way to align learning with them, and pitch your ideas to the C-suite, it doesn’t have to be.